Is 100k a good salary in the UK?

Earning £100,000 puts you in the top 5% of earners in the UK, and sees you taking home between £5,400 and £6,000 a month. This article breaks down what it would mean to earn £100,000 in the UK

Key takeaways

- Earning £100,000 puts you in the top 5% of earners in the UK.

- Roughly 3 million people earn over £100,000 in the UK.

- £100,000 is roughly £5,500-£6,000 per month in take home pay.

- If you earn £100,000, you earn £65,000 more than the average UK employee.

Table of contents:

- Is 100k a good salary?

- Breaking down 100k after tax

- How much rent could I afford on 100k?

- What mortgage could I get on 100k?

- What jobs pay 100k or more?

- Frequently asked questions

Is 100k a good salary UK?

In short, yes. £100,000 is a good salary and you could expect to live a very nice life on £100,000 in the UK. £100,000 should be enough to sustain a household anywhere in the country, especially outside of London, and even more so further up into the Midlands and the North, where the costs of living and housing are much cheaper.

If you’re wondering how £100,000 compares to other salaries in the country, £100,000 would put you somewhere in the top 5% of earners. The average salary in the UK sits at roughly £35,000 as of 2023 (although with the sky-rocketing inflation of this year it’s likely to be higher when the figures for 2024 come out).

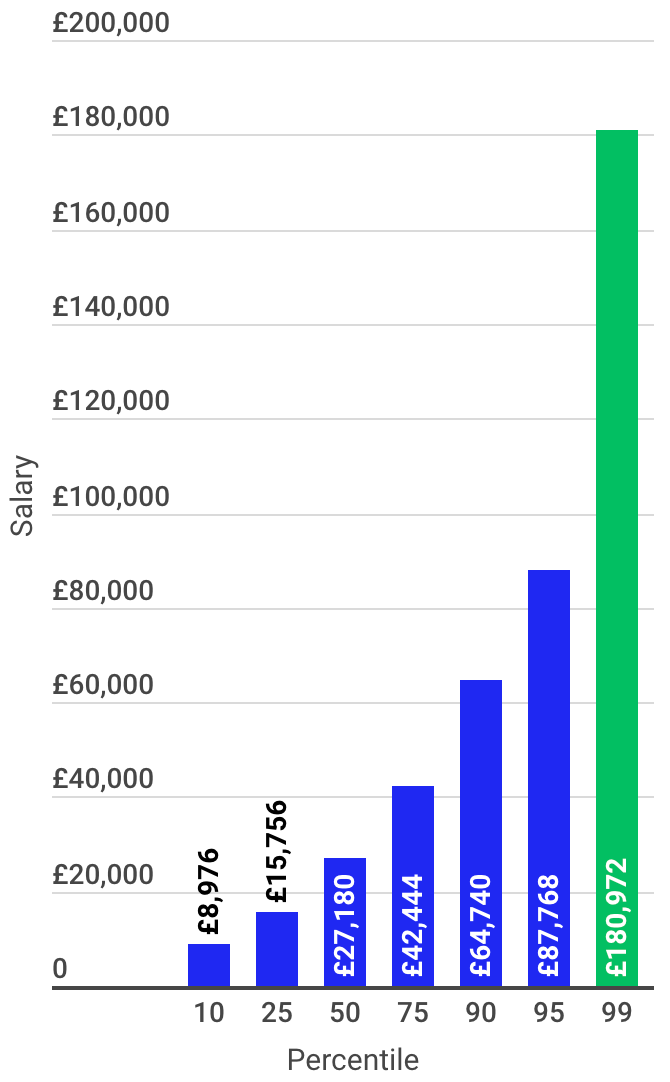

Here’s a visual breakdown of where £100,000 sits in relation to other salaries:

While £100,000 puts you in the top 5% of earners in the UK, you'd need to be earning £180,000+ to be in the top 1%, which you can see in green.

Breaking down 100k after tax

Calculating your post-tax income can vary based on individual circumstances. You’ll need to factor in the following:

- Income tax.

- National Insurance contributions

- Pension contributions.

- Student loans.

- Other deductions.

In the table below you can see the a rough estimate of what £100,000 might look like after tax, using an online salary calculator tool.

The take home pay on £100,000 is in the region of £5,437 a month.

| Year | Month | Week | |

| Gross Wage | £100,000 | £8,333 | £1,923 |

| National Insurance | £5,330 | £460 | £106 |

| Pension | £3,000 | £250 | £58 |

| Pension HMRC | £1,200 | £100 | £25 |

| Student Loan | £0 | £0 | £0 |

| Take Home Pay | £65,438 | £5,437 | £1,255 |

| Tax Free Allowance | £12,570 | £1,048 | £242 |

| Tax Paid | £26,232 | £2,186 | £504 |

How much rent could I afford on £100,000?

A lot! With a £100,000 salary you’d be able to afford a two bedroom flat easily in any UK city. Then, depending on the region, you could afford much, much more.

Take a look at the average rents across the UK to get an idea of what you can afford. It’s safe to assume rents outside of cities will be cheaper.

Cost of monthly rents for 'Two Bedroom' properties in 2023

| Region | Average | Lower quartile | Median | Upper quartile |

| England | £899 | £625 | £800 | £1,050 |

| North East | £543 | £450 | £500 | £600 |

| North West | £682 | £525 | £630 | £775 |

| Yorkshire and the Humber | £674 | £525 | £632 | £795 |

| East Midlands | £668 | £575 | £650 | £750 |

| West Midlands | £715 | £600 | £695 | £800 |

| East | £946 | £760 | £900 | £1,100 |

| London | £1,727 | £1,313 | £1,500 | £1,857 |

| South East | £1,049 | £875 | £1,000 | £1,200 |

| South West | £859 | £700 | £800 | £950 |

As you can see, with take home pay in the region of £5,500, you'd be able to afford a Two Bedroom place to rent, even in the most expensive parts of the country.

Taking London for example, you could rent a property in the upper quartile of rental prices (£1,857), and you'd still have over £3,600 left for other living expenses.

What mortgage can I get for £100,000?

While some lenders will offer more than others, as a rule of thumb, most applicants can borrow up to 4 or 4.5 times their annual income based on mortgage affordability rules.

So, if you're on £100,000 that means you can borrow somewhere in the region of £400,000 to £450,000.

Plugging £450,000 into a mortgage calculator, and assuming a 4.5% interest rate, you'd be looking at paying back around £2,500 a month on your mortgage payment.

To get a more detailed breakdown it’s worth visiting mortgage providers directly and entering your specific information into their mortgage calculators.

What jobs pay £100,000 or more?

Here is a breakdown of some roles and industries which can pay £100,000 or more given the right levels of experience.

Medical Professionals:

- Surgeons: £75,000 to £100,000 (depending on experience and specialisation)

- Anesthesiologists: £35,000 to £100,000

- Orthodontists: £40,000 to £250,000+

- GPs with specialisations: £60,000 to £150,000

- Psychiatrists: £40,000 to £150,000+

Financial Sector:

- Investment bankers: £60,000 to £200,000+

- Fund managers: £60,000 t0 £200,000+ (depending on assets managed)

- Financial analysts: £30,000 to £100,000+ (based on experience)

- Corporate treasurers: £45,000 to £150,000

- Chief Financial Officers (CFOs): £80,000 to £250,000+ (depending on company size)

Legal Professionals:

- Barristers: £25,000 to £1,000,000+ (depending on seniority and cases)

- Partners in law firms: £70,000 to £1,000,000+ (depending on firm and seniority)

- Corporate lawyers: £40,000 to £150,000+

- Judges: £100,000 to £250,000+ (depending on level and jurisdiction)

IT and Tech:

- Chief Technology Officers (CTOs): £80,000 to £200,000+ (depending on company size)

- Software development managers: £50,000 to £120,000+

- Information Security Managers: £50,000 to £100,000+

- Data Scientists: £40,000 to £120,000+ (based on experience and skills)

Business Management:

- Chief Executive Officers (CEOs): £70,000 to £1,000,000+ (depending on company size)

- Management Consultants: £40,000 to £150,000+

- Directors in larger companies: £80,000 to £250,000+ (depending on company size and sector)

- Sales Directors: £60,000 to £150,000+

Engineering:

- Petroleum Engineers: £40,000 to £100,000+ (depending on experience and sector)

- Aerospace Engineers: £30,000 to £90,000+

- Engineering Directors: £70,000 to £150,000+ (depending on company size and sector)

Real Estate:

- Property Developers: £40,000 to £150,000+ (depending on projects and success)

- High-end Real Estate Agents: £50,000 to £200,000+ (based on sales and commissions)

Entertainment and Media:

- Actors/Actresses: Varies greatly, from minimum wage to millions for A-list stars

- Directors: £40,000 to £250,000+ (depending on project and success)

- Producers: £30,000 to £200,000+ (based on project success and involvement)

- High-profile journalists or broadcasters: £40,000 to £500,000+ (depending on platform and experience)

These are just some of the better known career paths which might take you to £100,000, however, there are lots of others worth looking into.

High paying industries such as finance, law and consulting are common paths for those looking to make a big salary. However, outside of those areas you can still make a lot in the corporate world - particularly in C-Level roles.

Frequently asked questions

- Is £100,000 considered middle class?

- If you asked most people, they'd consider £100,000 salary to make you comfortably middle class, or even upper-middle or upper class depending on who you're asking

- Is £100,000 enough to live on in London?

- As with everything this depends on the lifestyle you want to lead, but the short answer is yes. It is definitely feasible to live in London on £100,000, especially when you consider the average salary in the capital is around £40,000.

- What percentage of people earn more than £100,000 in the UK?

- As you can see in the chart above, less than 5% of people earn more than £100,000 a year in the UK - though it is hard to put an exact figure on it, as this data changes regularly.