What is a good salary in London?

When asked, Londoners themselves believe £65,000 to be the salary you need to live comfortably in the capital.

Key takeaways

- Londoners say you need to earn over £65,000 to live comfortably.

- The average salary in London is £57,400 as of 2023.

- The biggest cost in London is property, with an average 2 bed renting at around £1,500 a month.

Table of contents:

- What is a 'good' salary in London?

- What does £65,000 look like after tax?

- Cost of living in London

- Could I live in London on my salary?

- Average salaries by profession in London

- Frequently asked questions

What is a good salary in London?

A recent article in The Telegraph suggested you'd want to make more than £65,000 to live comfortably in London, to combat the rising cost of living - based on data gathered by Reed.co.uk, the jobs and recruitment site.

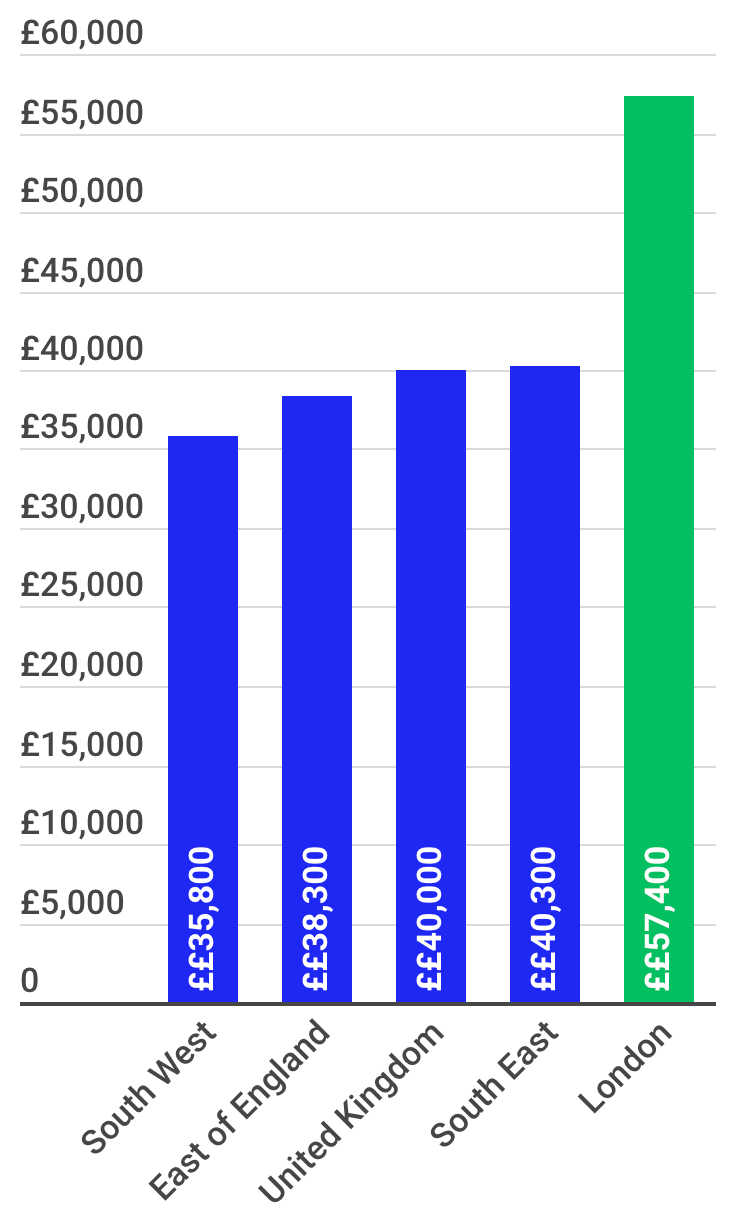

In 2022, the ONS reported the mean salary of full time employees in London was £57,400. This figure, while higher than the rest of the UK, is likely to rise by the end of 2023 due to the ballooning cost of living in all across the country over the last 12 months.

You can see how London compares to the rest of the UK's average salaries below:

So, what does £65,000 look like after tax?

If you plug £65,000 into an income tax calculator, which we've done, you'll get results like these below (we've assumed for argument's sake someone on £65,000 is paying back a student loan).

After tax, you'd have take home pay of around £3,500.

| Year | Month | Week | |

| Gross Wage | £65,000 | £5,417 | £1,250 |

| National Insurance | £4,630 | £402 | £93 |

| Pension | £1,950 | £163 | £38 |

| Pension HMRC | £780 | £65 | £16 |

| Student Loan | £3,393 | £283 | £65 |

| Take Home Pay | £42,375 | £3,516 | £811 |

| Tax Free Allowance | £12,570 | £1,048 | £242 |

| Tax Paid | £12,652 | £1,054 | £243 |

| Taxable Wage | £50,480 | £4,207 | £971 |

So, if we're taking the Telegraph article as gospel, then this is a the figure you'd need to live comfortably in the capital.

The cost of living in London

To get a sense of how far your salary will go in London, you need to take a look at the costs of living in the capital. Let's go through them.

Housing costs

This is usually the biggest expense. Rent prices vary significantly based on the type of accommodation, location, and size. A one-bedroom apartment in the city center can range from £1,500 to £3,000+ per month, while outside the city center, it might range from £1,000 to £2,000+ per month.

Here are some average rent prices for one-bedroom properties in the most expensive parts of London:

| Kensington and Chelsea | Studio – £1,427 | One bedroom – £2,062 |

| Islington | Studio – £1,383 | One bedroom – £1,565 |

| Tower Hamlets | Studio – £1,398 | One bedroom – £1,547 |

| Westminster | Studio – £1,371 | One bedroom – £2,113 |

| Lambeth | Studio – £1,240 | One bedroom – £1,595 |

And here are some of the cheapest boroughs for renting in London:

| Havering | Studio – £669 | One bedroom – £891 |

| Croydon | Studio – £762 | One bedroom – £964 |

| Sutton | Studio – £776 | One bedroom – £923 |

| Barking and Dagenham | Studio – £729 | One bedroom – £981 |

| Bexley | Studio – £688 | One bedroom – £854 |

Then here are the same boroughs, listing two and three bedroom properties:

| Westminster | Two bedroom – £2,920 | Three bedroom – £4,152 |

| Camden | Two bedroom – £2,254 | Three bedroom – £2,880 |

| Kensington and Chelsea | Two bedroom – £3,030 | Three bedroom – £4,938 |

| Islington | Two bedroom – £1,934 | Three bedroom – £2,487 |

| Hammersmith and Fulham | Two bedroom – £1,922 | Three bedroom – £2,653 |

| Bexley | Two bedroom – £1,105 | Three bedroom – £1,281 |

| Havering | Two bedroom – £1,120 | Three bedroom – £1,384 |

| Redbridge | Two bedroom – £1,293 | Three bedroom – £1,589 |

| Sutton | Two bedroom – £1,163 | Three bedroom – £1,498 |

| Waltham Forest | Two bedroom – £1,364 | Three bedroom – £1,649 |

As you can see, it's bloody expensive! If you consider that on £65,000 (the figure we mentioned above as what you'd need to live on to be comfortable), you'd be taking home roughly

Day-to-day expenses

- Tube: A monthly travel card for zones 1-2 could cost around £135-£160. If you use pay-as-you-go, costs might vary based on usage but could average around £100-£150 per month. A travel card will cover all transport in London (Tube, bus, train etc.)

- Food: Eating out at restaurants can vary greatly in cost, but a meal at an inexpensive restaurant might cost around £12-£20 per person. Groceries for a single person might amount to around £200-£300 per month, depending on eating habits and dietary preferences.

- Utilities: Basic utilities for an average apartment (heating, electricity, cooling, water, garbage) could cost around £100-£150 per month.

- Other costs like mobile or subscriptions are going to be exactly the same as elsewhere in the country.

Could I live in London on my salary?

Based on what we've been saying here, you're going to want to follow these steps to answer this question:

- Calculate your costs: Determine average expenses for housing, transportation, food, utilities, and other essentials in London.

- Compare the costs with your salary: Compare your salary with these expenses. Ensure your income comfortably covers these costs.

- Draw up a budget: Create a budget plan to manage your income effectively, considering living expenses, taxes, savings, and discretionary spending.

- See where you can be flexible: Be prepared to adjust your lifestyle and spending habits to fit within your budget constraints.

Ultimately, living comfortably in London on a specific salary requires careful budgeting, realistic expense expectations, and potential lifestyle adjustments.

Average salaries by profession in London

Here's a list of some of the typical salaries you see in the most common industries in London:

Finance:

- Financial Analyst: £35,000 - £55,000 per year

- Investment Banker: £60,000 - £150,000+ per year (including bonuses)

- Accountant: £30,000 - £60,000 per year

Technology:

- Software Engineer: £40,000 - £70,000 per year

- IT Project Manager: £45,000 - £80,000 per year

- Data Analyst: £30,000 - £50,000 per year

Healthcare:

- Doctor (General Practitioner): £55,000 - £85,000 per year

- Nurse: £25,000 - £40,000 per year

- Pharmacist: £35,000 - £55,000 per year

Legal:

- Lawyer/Solicitor: £40,000 - £100,000+ per year

- Legal Assistant/Paralegal: £20,000 - £40,000 per year

Education:

- Teacher (Primary/Secondary): £30,000 - £45,000 per year

- University Lecturer: £40,000 - £60,000 per year

Hospitality and Tourism:

- Hotel Manager: £30,000 - £50,000 per year

- Chef: £25,000 - £40,000 per year

Marketing and Advertising:

- Marketing Manager: £35,000 - £60,000 per year

- Advertising Executive: £25,000 - £40,000 per year

FAQs

- What is the top 10% income in London?

- The top 10% income bracket in London typically earns around £100,000 or more per year before taxes and other deductions.

- What is considered a good salary in London?

- In London, a good salary is often perceived to be around £50,000 to £60,000 per year, as it allows for a comfortable standard of living, covering housing costs, expenses, and providing some discretionary income. However, what constitutes a "good" salary can vary based on individual circumstances, lifestyle, and personal financial goals.

- Is 40k enough to live in London?

- Earning £40,000 a year in London can be sufficient for a comfortable lifestyle if you manage expenses sensibly, prioritise spending, and potentially share accommodation to lower housing costs.

- Is 120k a good salary in London?

- Yes, earning £120,000 a year in London is generally considered a high salary that can provide a very comfortable standard of living, covering various expenses and allowing for significant discretionary spending and savings.

- Can you live off 30k a year London?

- Living on £30,000 a year in London might be challenging, requiring careful budgeting, potentially sharing accommodation, and making considerable lifestyle adjustments to manage living costs in an expensive city like London.

- What is the lowest salary in London I can have to live comfortably?

- Living comfortably in London often requires a salary upwards of £40,000 to £50,000 per year, allowing for a more manageable balance between expenses, housing costs, and discretionary spending in this expensive city.